The average Joe is shut out of many investing arenas not because he or she is not part of the elite, but because they simply don’t have the capital. But in the modern world, we all would like to invest our money somewhere smartly. Many people are hesitant, but the reward of your money making more money is far too great for others to miss out on. Sensibility plays a huge role in how we make decisions because behind our wallets are our minds. Some of us wouldn’t mind a high-risk high reward investment plan, but for others, the odds have got to start in their favor. This kind of polar opposite in personality is everywhere no matter how rich or poor you are. Real estate has been and always will be the top dog in investment with the global property market valued in the hundreds of trillions of dollars. So you would think that with so much money floating around, there would be just as many opportunities. Put simply there didn’t use to be, as in truth you had to be rich to invest in lucrative real estate propositions. Not now though as real-world currency plays a bit part instead of running the show.

Tokenized opportunities

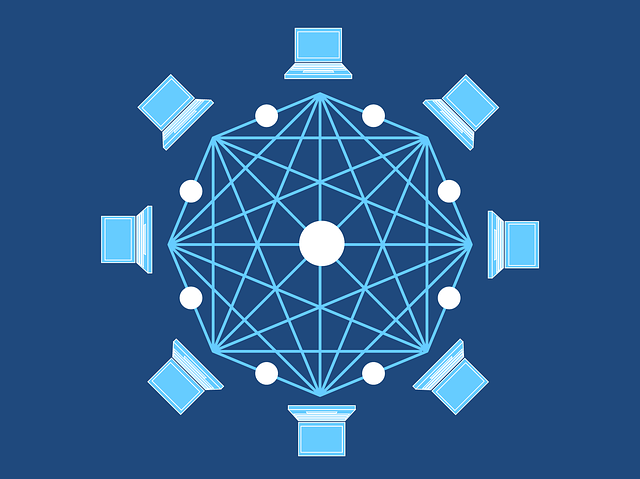

In an effort to make the real estate industry more transparent and fluid in how it does business. Tokenization is fast becoming the trend to hedge your bets on. Individual and asset management companies are willing to put their properties in the digital realm where there are more opportunities. Tokenization is simple, but because the concept is new, people often freak out and veer away from it as they think it’s too complicated or just a fool’s hope. A property owner can register his or her property with a cloud platform token blockchain. After being accepted by the company whose platform it is, they need to register their wallet in order to get ready to receive and distribute tokens to financial institutions; one of these systems is the i-house IHT Token. The property is then split up into different segments. Smart contracts for each part of the property are issued and then given a token as to what their real-world value really is. On the platform, the owner can track how their property is doing via the asset income display. They may also want to check out who is buying and who is selling via the asset transfer platform. Put into layman’s terms, properties are split up into tokens, and each token has its own value. These tokens can then be bought and sold freely with everyone keeping notes as to what’s going on, so there is absolute transparency.

Where Joe comes in

So now that properties are being accurately valued for each of their segments, this means they get split up. After tokens are assigned to them and then given to financial institutions, they are then sold to individual buyers. Because the properties have been segmented there are differing values to them. This gives the average Joe a chance to invest in a property without having to bust the bank. Rather than being an investor, you’re a buyer owning a piece of the pie without any obligation to hold onto it. As the smart contract can be bought and sold as a token, there is no need to involve a mediary either. Every transaction is open and honest, done on the cloud platform. This makes a blockchain meaning all the data of who bought what from who and for how much is not hidden. As there are many witnesses to the blockchain, the selling and buying is more honest and transparent therefore it invigorates one’s trust to buy. The legal side of investment puts the average Joe off his morning coffee. It’s boring and complicated to many, but in the past, it’s been necessary. However, with blockchain platforms that use tokens as the currency of buying and selling real estate, two birds are hit with one stone. Firstly the token system is actually quite simple to use even if you can’t understand it right away. Then the platform is self-regulated or rather transactions made in the public arena so all those involved, i.e. peers, regulate it themselves. The other benefit is that fact that even people with small amounts of investment funds can get involved.

As the properties in cloud platforms are segmented, parts of a property can be bought rather than the entire asset. This also means that due to the sheer number of investors, token values can go up and thus your token is now turning over a profit. This is the new way of making money and investing in real estate that everyone is watching right now.

Be First to Comment